- Home

- Financial Performance

Delivering results with operational excellence

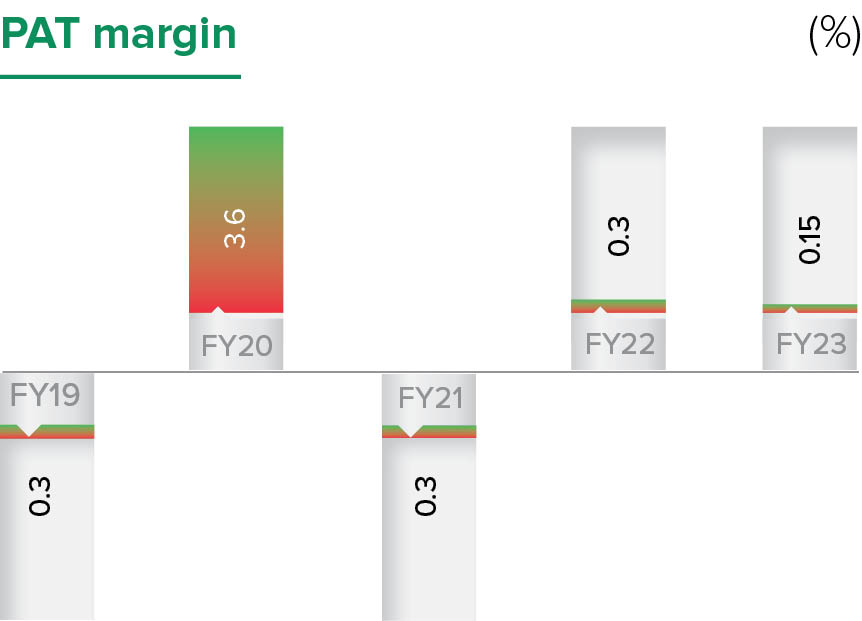

Key highlight of our financial performance for the year has been the strengthening of our balance sheet through measures reducing our net debt to ₹4,414 crores by the end of March 2023 and improvement in sales volumes to 18.8 million tonnes. The revenue from operations has grown 14% (Y-o-Y), touching ₹10,586 crores and EBITDA of ₹1,224 crores at FY 2022-23 year-end.

At Nuvoco, we ended the year with a significant jump of 41% (Q-on-Q basis) in our EBITDA even as the EBITDA for the year remained lower than ₹1,539 crores registered during FY 2021-22. The lower EBITDA is primarily due to a rise in raw material costs, fuel costs, and distribution costs during FY 2022-23. We have taken immediate steps to mitigate its impact on the business.

We have managed to absorb these shocks and enhance our financial capital despite facing challenges with respect to volumes in two of our key markets viz. West Bengal and Jharkhand during the second half of the year. We have efficiently contained our interest costs by managing the impact of increase in repo rate of 250 basis points. Nuvoco incurred capex of ₹486 crores during the year.

Our central focus for FY 2023-24 remains on debt reduction. Standing at ₹4,414 crores as on March 31, 2023, we have been successful at reducing our net debt by ₹650 crores from FY 2021-22 levels through efficient working capital management, and by ₹2,316 crores over the two years since March 31, 2021. Over the near term, we will continue to prioritise our CAPEX on our ongoing sustainability, debottlenecking, payback-based projects and expansion of our footprint in the North region to sustain this momentum.